How does an equity fund work?

7Newswire

26 Jan 2023, 13:01 GMT+10

Equity funds are a popular type of mutual fund that invests primarily in stocks. They offer investors the opportunity to gain exposure to a diversified portfolio of stocks and the potential for high returns. But how does an equity fund work? In this blog post, we will explore the mechanics of equity funds, the types of stocks they invest in, and how they can be used as part of a well-rounded investment strategy. We will also discuss the risks and benefits of investing in equity funds and how to choose the right one for your investment goals. Whether you're a seasoned investor or just starting out, understanding how equity funds work is essential for making informed investment decisions.

Understanding the basics of equity funds

Equity funds, also known as stock funds, are a type of mutual fund that invests primarily in stocks. Equity funds company is also known as mutual fund company. They are managed by professional fund managers who make investment decisions on behalf of the fund's shareholders. The fund's portfolio is structured and maintained to match the investment objective stated in its prospectus. The most common types of equity funds are index funds, actively managed funds, and sector-specific funds.

Index funds aim to replicate the performance of a stock market index such as the S&P 500. Actively managed funds are run by a team of fund managers who actively pick stocks to buy and sell for the fund. Sector-specific funds invest only in companies within a specific industry or sector, such as technology or healthcare.

The types of stocks equity funds invest in

Equity funds invest in a variety of stocks from different sectors and industries. The types of stocks that equity funds invest in can vary depending on the fund's investment objective and strategy. Some best equity fund may focus on large, blue-chip companies with a history of steady growth and strong dividends, while others may focus on small, up-and-coming companies with high growth potential.

How equity funds generate returns for investors

Equity funds generate returns for investors through the appreciation of the stock prices in the fund's portfolio. When the stock prices of the companies in the fund's portfolio increase, the value of the fund's shares also increases. Additionally, some equity funds also pay dividends to shareholders, which can provide a steady stream of income.

The benefits and risks of investing in equity funds

Equity funds offer several benefits to investors. One of the main benefits is the potential for high returns. Over the long term, stocks have historically provided higher returns than other types of investments such as bonds. Additionally, equity funds provide investors with diversification as they invest in a variety of stocks from different sectors and industries.

However, it's important to keep in mind that investing in equity funds also comes with risks. The stock market can be volatile and the value of the fund's shares can decrease if the stock prices of the companies in the fund's portfolio decrease. Additionally, the performance of the fund is dependent on the performance of the underlying stocks, which can be affected by a variety of factors such as economic conditions, company-specific events, and global events.

How to choose the right equity fund for your investment goals

When choosing an equity fund, it's important to consider the fund's investment objective, track record, management team, expense ratio, and yield. Additionally, it's essential to understand the underlying stocks and industries in which the fund is invested. It's also important to align the fund's investment objective and strategy with your own investment goals and risk tolerance. It's always advisable to consult a financial advisor to help you choose the right equity fund.

Using equity funds as part of a diversified investment portfolio

Equity funds can be a valuable addition to a diversified investment portfolio. By including equity funds in a portfolio, investors can gain exposure to a variety of stocks and industries, which can help to spread out risk potentially, it's important to remember that equity funds should not make up the entirety of an investment portfolio. It's crucial to diversify among various asset classes such as bonds, real estate, and cash. A well-diversified portfolio can help to reduce the overall risk of an investment.

Conclusion:

In conclusion, equity funds can be a valuable addition to an investment portfolio. They offer the potential for high returns and diversification, but it's important to understand the risks and choose the right fund for your investment goals. Additionally, equity funds should be used as part of a diversified investment portfolio to spread out risk and increase overall returns. It's always advisable to consult with a financial advisor to determine if equity funds are suitable for your investment strategy and to help you achieve your financial goals.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Liverpool Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Liverpool Star.

More InformationInternational

SectionNative leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

COVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

Fox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

UK

SectionCOVID-19 source still unknown, says WHO panel

]LONDON, U.K.: A World Health Organization (WHO) expert group investigating the origins of the COVID-19 pandemic released its final...

Shell rejects claim of early merger talks with BP

LONDON, U.K.: British oil giant Shell has denied reports that it is in talks to acquire rival oil company BP. The Wall Street Journal...

Trump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

Kate Winslet's visit sparks profit jump at Ballymaloe Cookery School

DUBLIN, Ireland: Post-tax profits at Ballymaloe Cookery School rose by 53 percent in 2024 to 135,952 euros, helped by the buzz around...

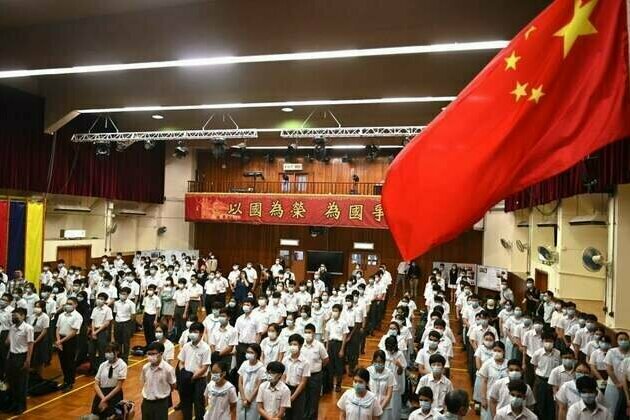

China: Building a 'Patriots Only' Hong Kong

(New York) - China's government has erased Hong Kong's freedoms since imposing the draconian National Security Law on June 30, 2020,...

Why is Islamophobia so hard to define?

The UK government wants a new definition of Islamophobia and has created a working group of politicians, academics and independent...