Tips for Maintaining a Good Credit Score

7Newswire

16 Jul 2022, 21:32 GMT+10

Your credit score is something that defines your financial health. Lenders use it to determine whether or not to give you a loan and, if so, at what interest rate. Keeping your credit score high isn't always easy, but it's important. Here are some tips for maintaining a good credit score.

Why does a good credit score matter?

According to Experian data from the third quarter of 2021, the average credit score is 714. Scores between 580 and 669 are considered 'fair,' while scores between 740 and 799 are considered 'very good.' This means that the average credit score is good but not fantastic. Anything above 800 is considered 'exceptional,' and an exceptional score is what earns the best interest rates and loan offers. It's possible to get an exceptional score—even if your current score is below average. It just takes some time, patience, and diligence.

Monitor your debt-to-income ratio and credit utilization

A debt-to-income ratio (DTI) is one of the most important factors in calculating your credit score. This number reflects how much debt you have compared to how much money you make. Ideally, you want this number to be low to qualify for more loans at better interest rates. Lenders like to see a DTI of 30 percent or less. This means that your total monthly debt payments, including your mortgage, should not exceed 30 percent of your gross monthly income. Ideally, you want your DTI to be as close to zero as possible to get a better credit score.

If your DTI is higher than 30 percent, your credit score may be lower than you'd like. To mitigate your DTI, take the time to pay off some of your debt. If you have debt across multiple credit cards or loans, consider getting all of the balances below the ideal DTI threshold. You can also try to increase your income and delay taking out additional credit card debt and loans. Giving yourself room to breathe will make this process less stressful.

Never max out your credit card limit.

Maxing out your credit card limit is never a good idea. You're essentially borrowing money you don't have at high-interest rates. Your credit score takes a big hit when you go over your credit limit. Additionally, depending on your credit card's terms, you may receive over-the-limit fees. If you have to use your credit card to cover an emergency expense, try to pay off your balance as quickly as possible. And if you can, try to avoid carrying a balance from month to month.

Pay on time, every time.

Your payment history makes up 35 percent of your credit score, so making all payments on time every month is crucial. Late payments can lower your credit score and may even lead to a default on your loan or credit card. If you are having trouble making all of your payments on time, contact your creditor and ask for help. They may be able to work with you to create a payment plan that fits into your budget. Some credit card companies waive your first missed payment, so if you're worried about this, consider seeking a card with this feature. If you are struggling to remember your payment dates, consider enrolling in a payment plan or using an online budgeting tool to help track your expenses.

Having a good credit score can help you save money over the long run. It shows that you're a reputable borrower and may even positively impact other areas of your life, like renting an apartment or getting a job. With this guide, you'll be well on your way toward better financial freedom and a fantastic score.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Liverpool Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Liverpool Star.

More InformationInternational

SectionFox faces $787 million lawsuit from Newsom over Trump phone call

DOVER, Delaware: California Governor Gavin Newsom has taken legal aim at Fox News, accusing the network of deliberately distorting...

DeepSeek faces app store ban in Germany over data transfer fears

FRANKFURT, Germany: Germany has become the latest country to challenge Chinese AI firm DeepSeek over its data practices, as pressure...

Canadian option offered to Harvard graduates facing US visa issues

TORONTO, Canada: Harvard University and the University of Toronto have created a backup plan to ensure Harvard graduate students continue...

Israel should act fast on new peace deals, Netanyahu says

JERUSALEM, Israel: Israeli Prime Minister Benjamin Netanyahu says that Israel's success in the war with Iran could open the door to...

UN offer rejected in Dreamliner crash investigation

NEW DELHI, India: India has decided not to allow a United Nations (UN) investigator to join the investigation into the recent Air India...

UN climate agency gets 10 percent boost amid global budget cuts

BONN, Germany: Despite widespread belt-tightening across the United Nations, nearly 200 countries agreed this week to increase the...

UK

SectionTrump-backed crypto project gets $100 million boost from UAE fund

LONDON, U.K.: A little-known investment fund based in the United Arab Emirates has emerged as the most prominent public backer of U.S....

Kate Winslet's visit sparks profit jump at Ballymaloe Cookery School

DUBLIN, Ireland: Post-tax profits at Ballymaloe Cookery School rose by 53 percent in 2024 to 135,952 euros, helped by the buzz around...

Amazon still trails UK grocers on fair supplier treatment

LONDON, U.K.: Amazon has once again been rated the worst major UK grocery retailer by its suppliers when it comes to following fair...

Hundreds of flights worldwide were grounded over Israel-US-Iran attacks

NEW YORK CITY, New York: The escalation of conflict between Israel and Iran, compounded by the United States' military involvement,...

How Chinese vapes reach US stores despite import restrictions

LONDON/NEW YORK/CHICAGO: In suburban Chicago, just 15 minutes from O'Hare International Airport, a small customs brokerage quietly...

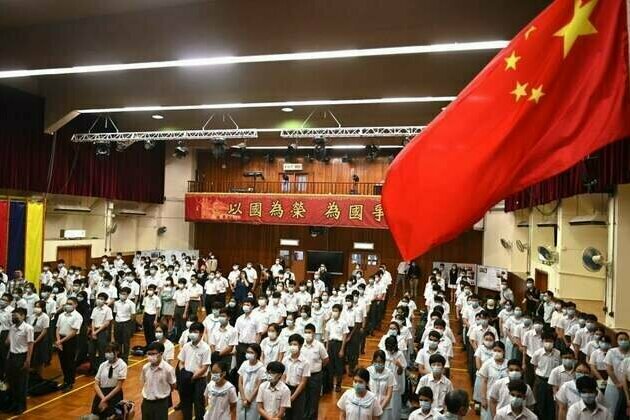

China: Building a 'Patriots Only' Hong Kong

(New York) - China's government has erased Hong Kong's freedoms since imposing the draconian National Security Law on June 30, 2020,...