Best Car Insurance In Florida

7Newswire

20 Nov 2021, 02:12 GMT+10

Across the state of Florida, there are close to 14 million drivers who pay an average of around $2,300 per year for auto insurance. Coming in at almost 32 percent more than the U.S. average, car insurance rates in Florida can be expensive. Just as in other states, however, insurance companies rely on various factors such as driving record, vehicle, location, and age to determine premium rates in Florida. As a Florida resident, you might pay more or less than the state average, depending on your specific situation. However, the good news is that there may be some ways that you can save on your insurance rates in the sunshine state.

Before you begin your search for insurance coverage, there are some things that you should consider. All drivers in Florida must carry Personal Damage Liability and Personal Injury Protection to operate a vehicle on the roadways legally. The coverage for both of these policies must be a minimum of $10,000 each. Because Florida is a no-fault state, personal injury coverage will pay for your bodily injury claims following an accident. Liability coverage will pay for property damage claims from other drivers.

In addition to liability and personal injury, many drivers choose to purchase collision and comprehensive coverage to protect their vehicle in a host of scenarios. Florida drivers have many options for car insurance coverage, and it will take some research and comparison shopping to find a rate and policy that works for you. Let's take a look at some of the best car insurance options in Florida.

Price

Overwhelmingly, most people consider price as a top factor for selecting car insurance in Florida. As discussed, the average Florida driver pays over 30 percent more for insurance than drivers in most other states. As a result, many drivers looking for full coverage seek to get the cheapest car insurance. While the average insuree in Florida pays more than $2,000 for coverage, it's possible to find insurance for lower rates. Based solely on the lowest average rates in Florida, USAA offered the lowest annual premium at just over $1,000. Progressive offered the highest average rates at around $3,200 per year. Depending on your location, car, and driving record, you can find the best car insurance rates for your situation.

Coverage

While insurance rates are a major concern, price shouldn't be the only consideration. As with many things, the cheapest might not always be the best. Coverage options should be heavily considered when looking for the best auto insurance. Aside from the required insurance that is mandated by the state of Florida, you might also consider policies that provide comprehensive and collision coverage. These policies will provide coverages for your car as a result of many things, from accidents to vandalism. Most insurance companies also offer uninsured motorist coverage, among other protections.

Discounts

The best way to get the cheapest car insurance rates in Florida is to maintain a clean driving record. Annual premium rates can be significantly higher for drivers with accidents and traffic violations. Additionally, many insurers offer a good driver discount for having zero offenses each year. The best insurance companies also offer other discounts in the form of incentives such as bundled policies and tracking devices. Finding cheaper car insurance rates in Florida is possible if you shop around and seek out discounts.

As with many other states, Florida requires auto insurance for every driver. As a Florida driver, you'll have to carry minimum liability and personal injury coverages. Given that rates in the sunshine state can be significantly higher than in other states, you'll want to seek out the best coverage from companies that offer discounts and incentives.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Liverpool Star news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Liverpool Star.

More InformationInternational

SectionTravelers can now keep shoes on at TSA checkpoints

WASHINGTON, D.C.: Travelers at U.S. airports will no longer need to remove their shoes during security screenings, Department of Homeland...

Rubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

Warsaw responds to migration pressure with new border controls

SLUBICE, Poland: Poland reinstated border controls with Germany and Lithuania on July 7, following Germany's earlier reintroduction...

Deadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...

Putin fires transport chief, later found dead in suspected suicide

MOSCOW, Russia: Just hours after his sudden dismissal by President Vladimir Putin, Russia's former transport minister, Roman Starovoit,...

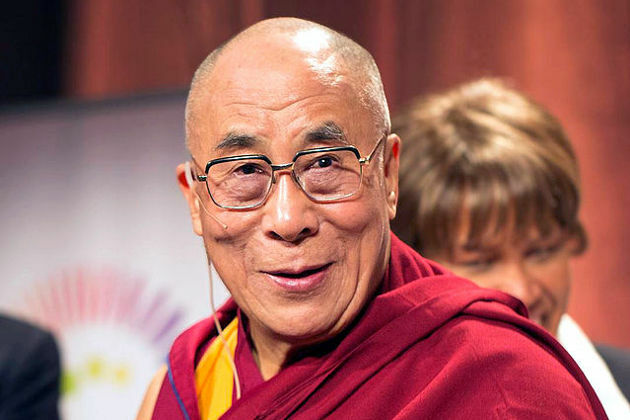

Thousands gather in Himalayas as Dalai Lama celebrates 90th birthday

DHARAMSHALA, India: The Dalai Lama turned 90 on July 6, celebrated by thousands of followers in the Himalayan town of Dharamshala,...

UK

SectionGold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

BP appoints ex-Shell finance chief Simon Henry to board

LONDON, U.K.: This week, BP appointed Simon Henry, former Shell finance chief, to its board as a non-executive director effective September...

Russia among 4 systemic risk countries for Italian banks

MILAN, Italy: Italian regulators have flagged four non-EU countries—including Russia—as carrying systemic financial risk for domestic...

Daily World Briefing, July 11

UN humanitarians say first fuel in 130 days allowed into Gaza but much more needed The first batch of fuel in more than four months...

Report: Wimbledon to rake in more than $500M in revenue

(Photo credit: Susan Mullane-Imagn Images) Wimbledon is not only a grand slam tennis tournament but a major revenue generator expected...

BRITAIN-LONDON-PM-FRANCE-PRESIDENT-MEETING

(250710) -- LONDON, July 10, 2025 (Xinhua) -- British Prime Minister Keir Starmer (L) welcomes French President Emmanuel Macron at...